The Reserve Bank predicts interest rates to rise as early as August, half a year earlier than previously expected.

Westpac economics team is tipping a 0.15 percentage-point cash rate rise in August, followed by another 0.25 percentage-point increase in October.

RateCity, a financial comparison website, said those two moves would increase $103 a month to interest repayments on a general $500,000 mortgage.

Economists recommend getting ahead on repayments now while interest rates are still low to prepare for future hikes.

Westpac predicts this earlier increase because they feel the RBA has been too conservative in its predictions around unemployment, wages and inflation.

By August, Westpac anticipates the Reserve Bank’s preferred measures of consumer prices to have met, or surpassed, the mid-point of its 2-3% target range for three quarters in a row.

The annual wage growth is expected to be running at 3 per cent by the end of June due to a shortage of workers filtering through to bigger pay rises from employers to attract and retain staff.

The ABS highlighted the shortage of available workers in recent data released, shortly after Westpac’s new predictions were published which showed a jobless rate of 4.2 per cent in December, the lowest since August 2008.

While economists do anticipate the Omicron COVID-19 variant to affect the Australian economy, they also expect the effect will be transitory, however they do see potential risk of future variants especially leading into winter.

Economists also predict that the reopening of international borders will reduce some of the labour shortages that have been driving up wages.

Apart from bringing forward the timing of the first rate increase by six months, economists have also altered their predictions for how many rate rises will be necessary to keep inflation in check.

Previously it was expected that the cash rate to max out at 1.25 per cent during the current cycle, but is now tipping a peak cash rate of 1.75 per cent by March 2024. Regardless, that is a 1.65-percentage-point increase on the current RBA cash rate target of 0.1 per cent.

The RBA figures show the average existing variable borrower is on a rate just below 3 per cent, that would take typical mortgage rates above 4.6 per cent.

To put this into perspective, that would cost someone with a typical mortgage an extra $427 a month in repayments after March 2024.

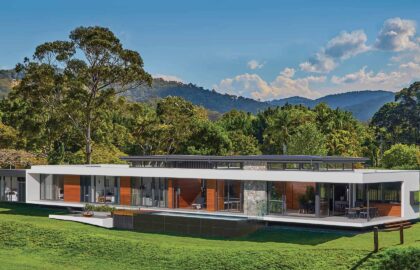

The market is changing, now is the time to sell! Contact us today to book your free home assessment.

DISCLAIMER – The information provided is for guidance and informational purposes only and does not replace independent business, legal and financial advice which we strongly recommend. Whilst the information is considered true and correct at the date of publication, changes in circumstances after the time of publication may impact the accuracy of the information provided. Professionals Burleigh will not accept responsibility or liability for any reliance on the blog information, including but not limited to, the accuracy, currency or completeness of any information or links.