When it comes time to sell your home or investment property, at first glance it might appear to be a simple process of contacting an agent, listing, selling and moving onto your next property.

There is an array of costs that should be considered when you enter the selling journey, it’s wise to be aware of the upfront costs plus the ones that may pop up throughout your sale so that you’re able to budget and be prepared.

Real Estate Agent Fees & Commission

The region and state you are in will determine the commission rate you may be charged by an agent for their services. Commission rates vary from around 1.5% up to 3.5%, and some agents offer out the charge on a tiered structure based on the final sale price.

Some agents will charge a flat fee for the sale instead of a commission rate and will negotiate this with you at the listing appointment.

It’s also important to consider auctioneer fees in your budget should your agent choose to do an auction campaign rather than other forms of sale.

Marketing Costs

The commission rate charged by the agent will generally not include costs to market the property for sale therefore an additional marketing fee will be charged.

The marketing fees will cover the costs for photography, videography, the 3D virtual tour, signboards plus listing the property on online portals such as realestate.com.au and domain.com.au. It will also cover the costs of any promotional material such as flyers, social media marketing and Facebook advertisements promoting the property.

Real estate agents provide an array of marketing packages based on your home and the audience you’re looking to target. They should discuss their marketing packages with you and consider your budget and desire for the property sale.

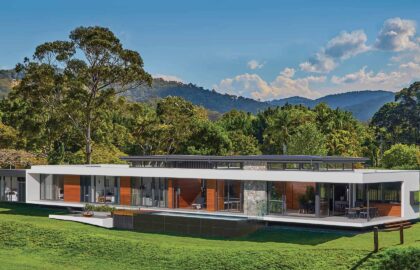

Property Styling

Engaging a professional to style your property can assist with attracting more potential buyers and appeal to a broader market.

Your agent may also suggest minor repairs and maintenance that they’d recommend be carried out prior to a sale to ensure you get top dollar for your property.

Solicitor or Conveyancer Fees

A solicitor or conveyancer will organize the exchange and settlement of contracts on your behalf plus the required searches and legal documentation that’s required during the process of transferring the property to the new owner.

The fees for your solicitors or conveyancers will be varied dependent on your region and the property requirements with some charging a flat fee or fees per service. Discuss pricing with your solicitor or conveyancer prior to engaging them for the sale of your property.

Bank Fees

There may be exit fees or other associated charges with discharging the mortgage on sale depending on the bank that holds your mortgage and the type of loan over the property. It’s worth checking with your bank prior to sale to determine any fees that you may be responsible for on the sale of the property.